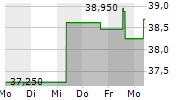

Bunzl FY Profit Rises; To Acquire Nisbets In UK And Pamark In Finland

Source: FinanzNachrichten.de

LONDON (dpa-AFX) - Bunzl Plc (BZLFY.PK, BNZL.L), a British distribution and outsourcing company, reported that its profit attributable to the company's equity holders for fiscal year 2023 increased to 526.2 million pounds or 156.0 pence per share from the prior year's 474.4 million pounds or 140.7 pence per share due to a 50.3 million pounds increase in profit before income tax, partly offset by a 10.2 million pounds increase in the tax charge at constant exchange rates. In a separate press release, Bunzl said that it has signed an agreement to acquire Nisbets in the UK and Pamark in Finland.

Bunzl's adjusted earnings per basic share for fiscal year 2023 were 191.1 pence, an increase of 2.7% at constant exchange rates or 3.7% at actual exchange rates.

Profit before income tax was 698.6 million pounds, an increase of 7.8% at constant exchange rates or 10.1% at actual exchange rates.

Annual revenue declined by 1.9% or 2.0% at actual exchange rates year-over-year to 11.80 billion pounds. Within this, acquisition growth of 2.5% was offset by underlying revenue decline of 2.9% and the impact of the UK healthcare business disposal in December 2022 which impacted revenue by 1.5%.

The company maintained its 2024 profit guidance published in its pre-close statement.

Following a slower than expected start to the year in North America, the company now expects to deliver slight revenue growth in 2024, at constant exchange rates, driven by acquisitions announced in 2023; with underlying revenue, which is organic revenue adjusted for trading days, declining slightly. Group operating margin is now expected to be slightly below 2023.

The company said its board recommended a final dividend of 50.1 pence, 10.4% higher than the prior year, resulting in a full year dividend of 68.3 pence. This represents an 8.9% increase in the total dividend compared to 2022.

Meanwhile, Bunzl said it has signed an agreement to acquire an 80% stake in Nisbets and associated entities for an initial consideration of 339 million pounds in cash. An additional earn-out amount may be payable based on Nisbets' financial performance in 2024.

Founded in 1983 by Andrew Nisbet, Nisbets is an omni-channel distributor of catering equipment and consumables in the UK & Ireland, Northern Europe and Australasia, offering an extensive product range including a wide range of own-brand products to foodservice customers. It has over 1,800 employees and an experienced management team, with Andrew Nisbet acting as a non-executive director and the family continuing to hold a minority interest in Nisbets.

The transaction includes put / call options that enable Bunzl to acquire the remaining 20% stake in the future at a price based on Nisbets' financial performance at the time of option exercise, subject to certain conditions.

The transaction is expected to be meaningfully accretive to earnings per share in the first full year following completion.

In January, Bunzl signed an agreement to acquire its first business in Finland, Pamark. This anchor acquisition in Finland is expected to complete later this month and will increase the number of countries in which Bunzl operates to 33.

Pamark is a distributor of cleaning & hygiene, healthcare, foodservice and safety products to a broad range of private and public sector customers in Finland. The company generated revenue of 56 million euros in 2023.

Copyright(c) 2024 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFXChina Knaller 2024: Diese 5 Aktien sind echte Geheim-TippsDer kostenfreie China-Report enthüllt gleich fünf Geheim-Tipps, die zu echten Outperformern werden könnten. Lesen Sie den kostenfreien Report und nutzen Sie die Chancen rechtzeitig!Hier klicken