Free tax help on Cape Cod can relieve burden of worry. Here's what to know.

Source: Yahoo! Finance

CHATHAM -- No one likes doing their taxes or paying someone to prepare their tax returns, but the deadline is looming to send one's tax return by April 16 in Massachusetts.

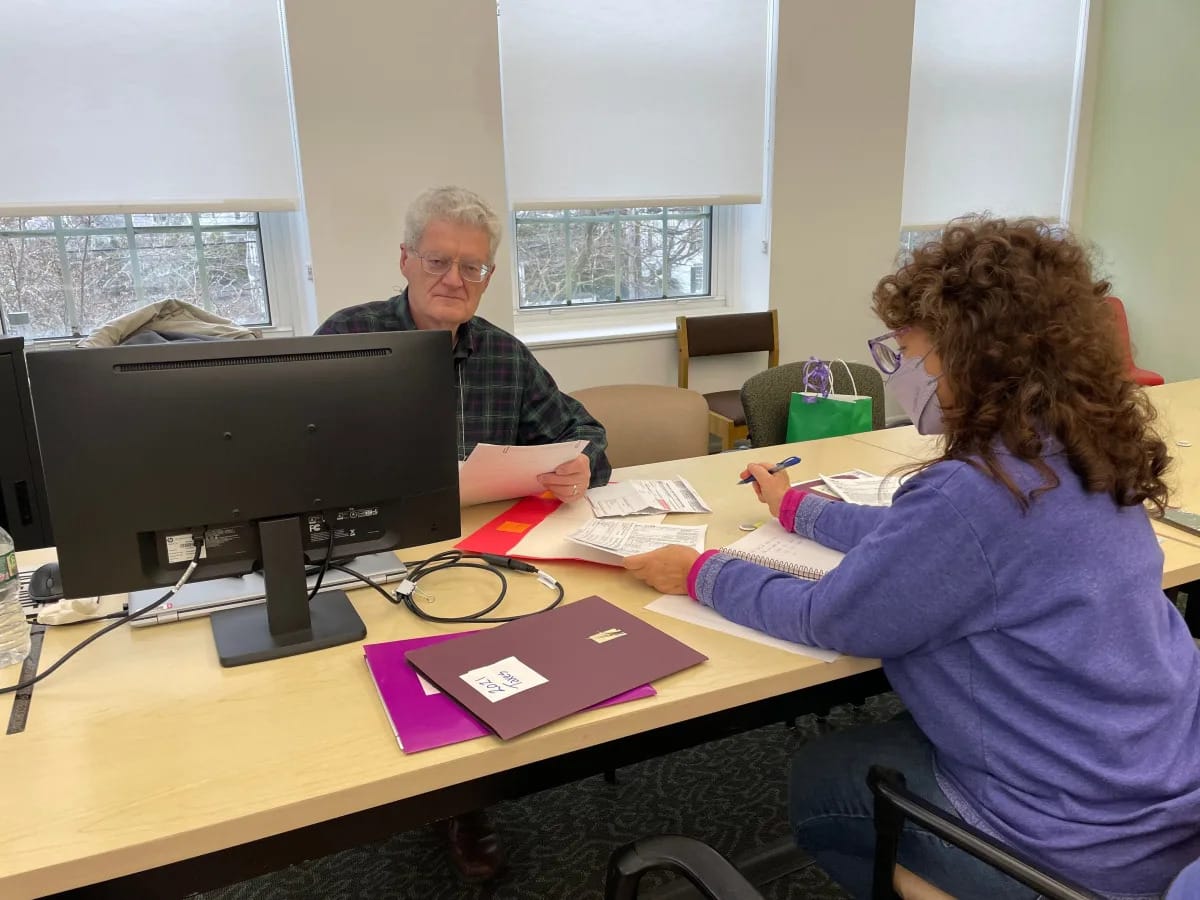

There is a way to get your taxes done without the stress and without paying a dime to preparers who actually enjoy doing them for you. Eighty-five trained volunteer tax preparers are doing federal and state tax returns at 21 sites across the Cape this year and every year. They serve every town from Wareham to Provincetown under the AARP Foundation Tax-Aide program in conjunction with the Internal Revenue Service.

Started in 1968 in Florida, the AARP program serves 75 million people nationwide yearly. "It's the largest free tax assistance in the country," Terry Hendrix, local coordinator in the Chatham and Wellfleet tax sites, said Wednesday in the office space at the Chatham Community Center.

Half-dozen preparers work every Tuesday and Wednesday for 10 weeks.

"All preparers are volunteers from every walk of life," he said. Hendrix has an MBA in finance and is retired from Hewlett Packard. He estimated he has prepared about 120 tax returns this season.

Most of the preparers are retirees who go through five weeks of training the first year and refresher classes every year after. They must pass three IRS exams with an 80% score or better, Hendrix said. The volunteers are also asked to commit to two days a week over the 10-week tax season that begins the first week of February, but there can be exceptions. "We respect people's time and energy," he said.

Mary Jackson of Harwich, who has been an AARP tax preparer for nine years at the Chatham site that also serves Harwich, said the tests, now all done online, involve a lot of research and problem solving to unravel the 30,000 pages of the federal tax code. She has put her experience to good use after working for H&R Block for 15 years, on Wall Street as a stock broker and doing other brokerage work -- all after being a television soap opera actress for many years in New York.

"I enjoy helping people," Jackson said. "I enjoy the mental stimulation." She added that people who come in "give us a lot of smiles and many thanks."

Richard Nevins, a new resident of Eastham, is in his first year at the Chatham tax site. He said he sees the service as a responsibility.

"It's not a burden; it's a joy," Nevins said. He also likes feeling part of the community. Nevins had to go through the initial training and pass the tests despite having done taxes for clients as a lawyer since 1969. He also taught high school for 20 years.

The preparers take pride in their work.

"We want to make sure there are no errors," Nevins said, noting that the AARP tax preparers have an "extremely low reject rate of around 1%" with the IRS. Their system involves checking each other's work after each return is completed. The returns are then sent electronically to the federal and state IRS offices.

Late Wednesday afternoon, Hendrix was helping Beth Cahoon of Brewster, who had her 2023 taxes done there previously but returned for an extra check on her previous year's taxes that she had done on her own. She said it had been difficult to do the taxes because of a chronic illness for 21 years and dyslexia, so she was glad to find the free tax service when she recently turned 60 and moved to the Cape.

Cahoon was looking for some social activities at senior centers and found the notice online about the tax service. She immediately called for an appointment and was grateful to be put on a waiting list.

All sign-ups for the tax service are done through town Councils on Aging, usually starting in January and the slots fill up fast. Although most of the tax sites are well booked for the season, Hendrix said, people could try calling in case a place opens up.

The AARP Tax-Aide is geared toward seniors and low- to middle-income people, but Hendrix said, "We turn away almost no one." He noted that he prepared the taxes for three generations of one family, from high schoolers to grandparents as well as a young man who worked at the community center.

The service can prepare most returns involving wages, investments, pensions and other retirement income, Social Security benefits and self-employment income. Hendrix said the preparers do taxes for many small businesses on the Cape.

Hendrix also trains the preparers, and he said he always needs more volunteers. Those interested can contact Hendrix before the fall training at [email protected].

The Cape Cod Times is providing this coverage for free as a public service. Please take a moment to support local journalism by subscribing.