Police warn of new fixed deposit scam, which has claimed at least a dozen victims with at least S$650,000 lost

Source: Yahoo News

SINGAPORE -- A new scam trend has emerged where scammers impersonate banks and offer victims fixed-deposit scheme promotions with high interest rates.

The Singapore Police Force said in a media release on Thursday (11 April) that at least 12 victims have fallen prey to the scam since January 2024, with total losses amounting to at least S$650,000.

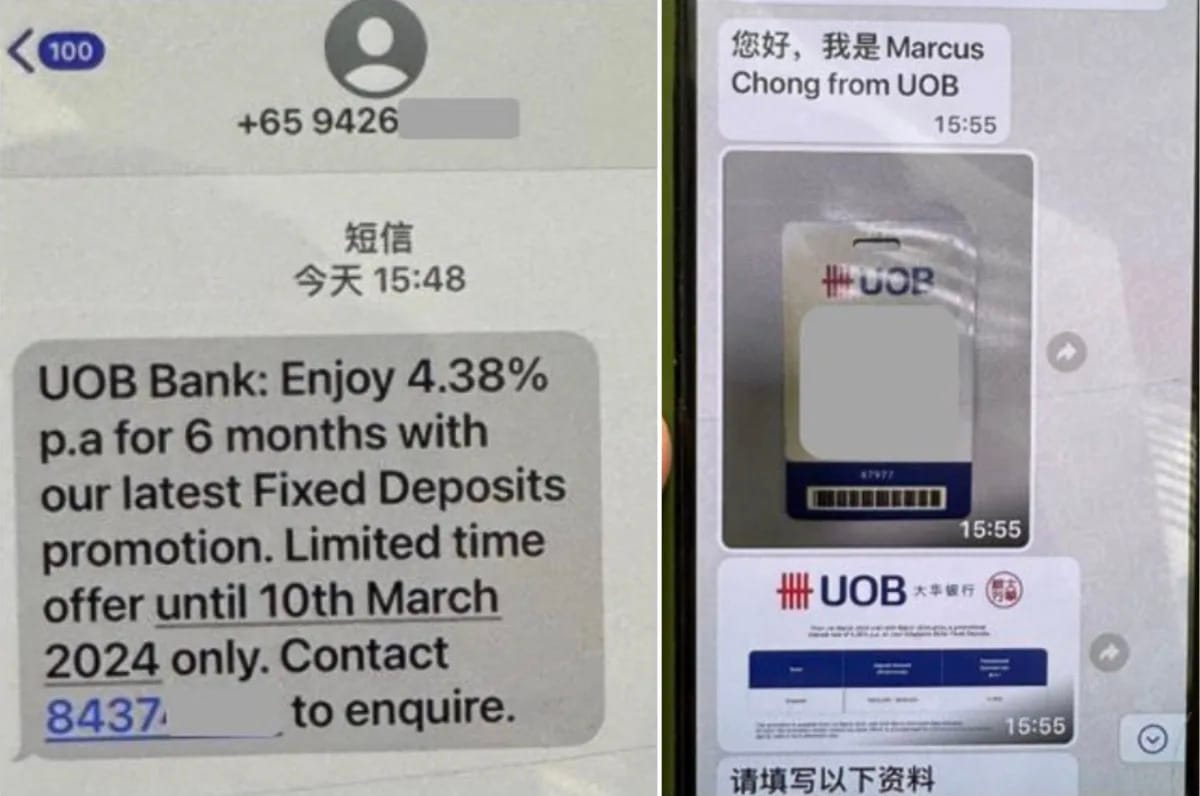

Victims would receive SMSes from unknown +65 local mobile numbers, allegedly from local banks, offering fixed-deposit schemes with high interest rates. They would be instructed to contact a number provided within the SMS to indicate their interest and obtain more details about the promotion.

"Once contacted, scammers would pose as bank agents and provide fraudulent identification such as staff passes. They would then seek victims' personal particulars to 'apply for the fixed deposit promotion' and subsequently claim to have registered a bank account under the victims' names," said the police.

In some cases, victims would receive forged bank statements claiming that new bank accounts had been opened under their names. Subsequently, they were instructed to deposit or transfer money into these accounts.

The scammers would dissuade victims from seeking further verification by claiming that the accounts had been created for them, or were intended to "hold the funds prior to the creation of their account".

Victims would realise that they had been scammed after logging into their banking applications where they would find no changes to system records.

"In some instances, the scammer would quote an 'activation period' which delays the discovery of the scheme," said the police.

Upon eventually checking directly with the banks, victims were informed that those accounts belonged to other people.