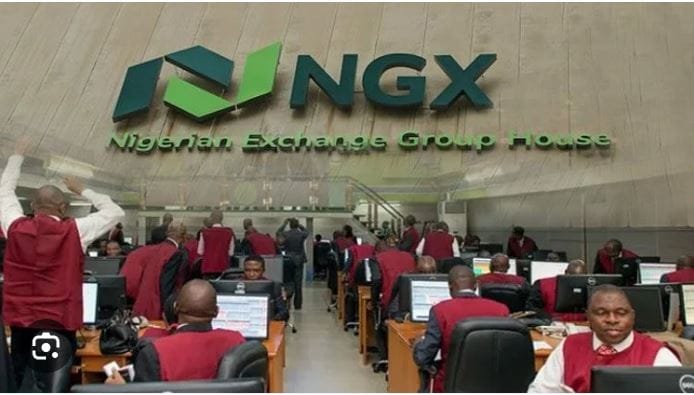

NGX Group Set To Digitise Process Of Banks Recapitalisation Exercise | Independent Newspaper Nigeria

Source: Independent Newspapers Nigeria

LAGOS - The Nigerian Exchange Group (NGX Group) said it is going to drive the process of raising the needed capital by banks in the country in the Central Bank of Nigeria's (CBN) banks recapitalisation exercise with the use of technology.

Temi Popoola, the Group Managing Director/Chief Executive Officer of the Group, disclosed this on Monday at the 63rd annual general meeting in Lagos while speaking to shareholders of the Group.

He said the Group is trying to run a digital journey that will bring development to the Group as it is setting up a technology subsidiary to drive the process after identifying a big gap that must be filled.

He said, "We have identified a big gap and that big gap is technology. Look at the broader financial markets, the broader financial market consumes technology. On this phone right now you can open an account with any of the new digital banks in one minute, download the app and in one minute, you will move money from your traditional bank account to that account and vice versa.

"Why are our capital markets not going in this direction? And the way to do that journey is that we are aware that every one of our subsidiaries or associate companies used to consume technology somehow and there is no better entity to drive this than the holding company.

"So what do I mean? For example, we have a unique opportunity in front of us now with the capital exercises that are coming up. The capital raising that the CBN has announced, outside the financial community as well, there have been many capital raising that have been publicly announced. Right issues and public offers.

"We will be launching very soon an application that would allow these public offers to be distributed to any Nigerian as long as you have a bank account. So for the first time you sit on your device, log into your bank account to be able to invest in a public offer with a few button clicks.

"We'll be able to go to Quick Teller, as you pay your bills, you will see that there's an offer that you can invest in. You'll be able to go to any of these digital banks. And as you're doing your business there, you will be able to invest. You'll be able to come to the NGX website, click on a link and be able to invest".

For this journey to happen, Popoola said the holding company has a digital journey that we are trying to add to drive efficiency and alignment with subsidiaries and that is what we have been missing.

He added, "It is very clear to us that the future of this group is technology. Ultimately, this is going to be a very technology-heavy entity and part of our structure and strategy that was spoken about. We are looking to have a subsidiary dedicated to technology.

"When we're building tech products, we want to be able to export those products. We want to think about how to commercialise those products that we are building".

Speaking to challenges being faced by exchanges across the continent, Popoola said the major challenge being faced by exchanges is that of trading engine, saying that most exchanges in Africa are paying hardcore dollars with their trading engines.

"If NGX can solve that problem locally, we can export them across the continent. So if we can solve this problem with the primary distribution or the right distribution, I spoke earlier, why can't we take that to Sudan and Ethiopia and to other exchanges?"

Chairman of the Group, Dr. Umaru Kwairanga, said the board is ready to bring forward new products that will enhance its services and that the offering of a final 75 kobo per share dividend in the 2023 financial year is an attestation that the Group is interested in its shareholders benefiting from their investment.

He was also glad at the unanimous approval given to the board to raise the N10 billion rights issue.

Shareholders of the group, aside from approving the new capital raising process, also approved a final dividend of 75 kobo, having initially been paid a 25 kobo interim dividend.