S$944 million in total forfeited to state as one of Singapore's largest money laundering cases concludes

Source: CNA

SINGAPORE: About S$944 million (US$697 million) in assets seized in relation to the 10 criminals embroiled in one of Singapore's largest money-laundering probes will be forfeited to the state, now that the last offender has been sentenced to jail.

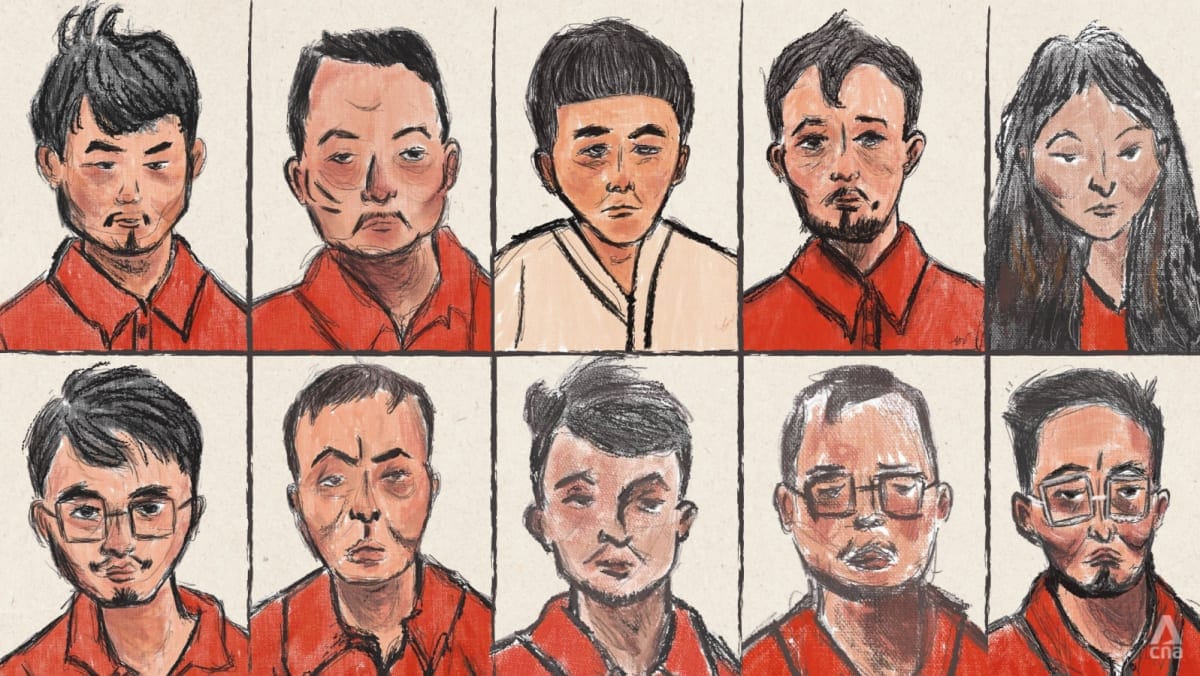

The probe, which began in 2021 with tip-offs on a group of foreigners using forged documents to launder money in Singapore, led to the simultaneous arrests of nine men and one woman - with origins in China - in moneyed estates around the island in August 2023.

In the months following the arrests, billions of dollars worth of assets linked to the offenders and other suspects on the run have been seized - including hard cash, luxury properties, branded goods, cryptocurrency and alcohol.

The offenders all pleaded guilty to various crimes, including money laundering, using forged bank documents and other related offences, such as lying to the Manpower Ministry to obtain work passes to enter Singapore.

They were sentenced to between 13 and 17 months' jail.

The 10th criminal, 36-year-old Vanuatu national Su Jianfeng, was sentenced to the longest jail term on Monday (Jun 10), bringing the saga to a close.

In a statement after the hearing, the Singapore Police Force (SPF) said the value of assets linked to the 10 offenders total more than S$1 billion to date.

About S$944 million worth of these assets have been ordered by the court to be forfeited to the state. This was after the 10 offenders agreed as part of their plea deals to have at least 90 per cent of their seized assets forfeited.

Of the 10, only one - Su Wenqiang - agreed to surrender 100 per cent of the estimated S$6 million seized from him.

Investigations are ongoing against 17 other suspects who are not currently in Singapore. Assets linked to these suspects make up the rest of the total S$3 billion figure seized.

In response to CNA's queries, a police spokesperson said the non-cash assets will be sold via channels such as auctions. Thereafter, the proceeds of the sale, along with the forfeited cash, will be paid into Singapore's consolidated fund - akin to a bank account held by the government.

Mr David Chew, the director of the SPF's Commercial Affairs Department, said the "swift and firm law enforcement efforts" and the "successful prosecutions" are testament to "our commitment to tackle transnational crime and disrupt the activities of organized crime syndicates".

"To protect Singapore's financial system, the police will spare no effort to detect abuse, arrest the criminals and deprive them of their ill-gotten gains. In Singapore, these criminals will not find safe harbour for themselves or their wealth," he said.

In a separate statement, the Chief Prosecutor from the Attorney-General's Chambers, Mr Tan Kiat Pheng, said the amounts involved across the 10 convicts' cases make this one of the largest money-laundering cases that Singapore has prosecuted.

"The swift prosecution of these ten cases is a strong message to would-be criminals that Singapore will not tolerate attempts to flout our laws," he said.

"We will take firm and swift action against those who exploit our system to launder illicit gains or commit white-collar crimes. We will continue to work closely with our law enforcement agencies and regulator to safeguard Singapore's hard-earned reputation and integrity as a global financial hub."